Business Intelligence Software for Smarter Financial Analysis

In today’s fast-paced business world, making informed decisions is crucial for success. Financial analysis plays a vital role in this process, as it enables organizations to evaluate their performance, identify areas for improvement, and make data-driven decisions. However, traditional financial analysis methods can be time-consuming, labor-intensive, and prone to errors. This is where Business Intelligence (BI) software comes in – a powerful tool that can revolutionize financial analysis and help organizations make smarter decisions.

What is Business Intelligence Software?

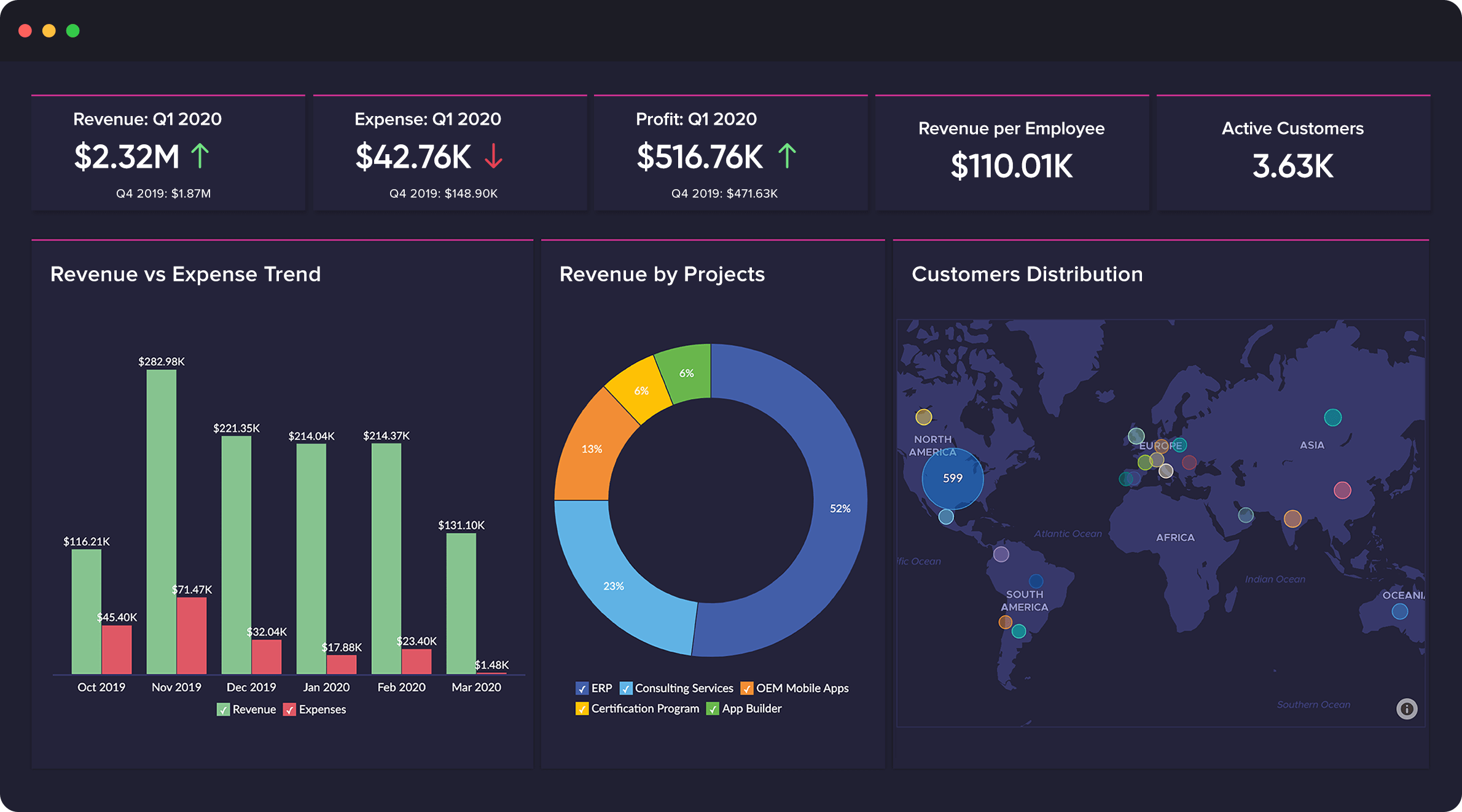

Business Intelligence software is a set of tools and technologies that enable organizations to collect, analyze, and visualize data from various sources. It helps users to gain insights into their business operations, identify trends and patterns, and make informed decisions. BI software can handle vast amounts of data, from financial statements to customer interactions, and provide real-time analytics and reporting.

Benefits of Business Intelligence Software in Financial Analysis

The benefits of using BI software in financial analysis are numerous. Some of the most significant advantages include:

- Improved Accuracy: BI software can automate many financial analysis tasks, reducing the likelihood of human error and ensuring accuracy in financial reporting.

- Faster Analysis: BI software can process large amounts of data quickly, enabling organizations to perform financial analysis in real-time.

- Enhanced Visualization: BI software provides interactive and dynamic visualizations, making it easier to understand complex financial data and identify trends and patterns.

- Better Decision-Making: By providing real-time insights and analytics, BI software enables organizations to make informed decisions that drive business growth.

- Increased Efficiency: BI software can automate many financial analysis tasks, freeing up staff to focus on higher-value activities.

Key Features of Business Intelligence Software for Financial Analysis

When selecting a BI software for financial analysis, there are several key features to look for:

- Data Integration: The ability to integrate data from various sources, including financial statements, accounting systems, and other business applications.

- Data Visualization: Interactive and dynamic visualizations, such as dashboards, reports, and charts, to help users understand complex financial data.

- Predictive Analytics: Advanced analytics capabilities, such as forecasting and predictive modeling, to help organizations anticipate future financial performance.

- Collaboration Tools: Features that enable users to share insights and collaborate with others, such as role-based access control and real-time commenting.

- Mobile Access: The ability to access financial analysis and reporting on-the-go, using mobile devices and tablets.

Best Practices for Implementing Business Intelligence Software in Financial Analysis

To get the most out of BI software in financial analysis, there are several best practices to follow:

- Define Clear Goals and Objectives: Establish clear goals and objectives for the BI software implementation, such as improving financial reporting or enhancing decision-making.

- Assess Data Quality: Evaluate the quality of financial data and ensure that it is accurate, complete, and timely.

- Choose the Right Software: Select a BI software that meets the organization’s specific needs and requirements.

- Provide Training and Support: Provide users with comprehensive training and support to ensure that they can effectively use the BI software.

- Monitor and Evaluate: Regularly monitor and evaluate the effectiveness of the BI software and make adjustments as needed.

Common Challenges and Limitations of Business Intelligence Software in Financial Analysis

While BI software can bring numerous benefits to financial analysis, there are also some common challenges and limitations to be aware of:

- Data Quality Issues: Poor data quality can limit the effectiveness of BI software and lead to inaccurate insights and decisions.

- Complexity: BI software can be complex and require significant technical expertise to implement and use.

- Cost: BI software can be expensive, especially for large-scale implementations.

- Change Management: Implementing BI software can require significant changes to business processes and culture.

- Security and Compliance: BI software must be implemented in a way that ensures the security and compliance of financial data.

Real-World Examples of Business Intelligence Software in Financial Analysis

There are many real-world examples of organizations using BI software to improve financial analysis and decision-making. For example:

- A large retail company used BI software to analyze sales data and identify opportunities to optimize pricing and inventory management.

- A financial services firm used BI software to analyze customer behavior and develop targeted marketing campaigns.

- A manufacturing company used BI software to analyze production costs and identify opportunities to improve efficiency and reduce waste.

Conclusion

In conclusion, Business Intelligence software is a powerful tool that can revolutionize financial analysis and help organizations make smarter decisions. By providing real-time insights and analytics, BI software can improve accuracy, speed, and efficiency in financial analysis. When selecting a BI software, it is essential to consider key features such as data integration, data visualization, and predictive analytics. By following best practices and being aware of common challenges and limitations, organizations can get the most out of BI software and drive business success.

Future of Business Intelligence Software in Financial Analysis

The future of BI software in financial analysis is exciting and rapidly evolving. Some of the trends that are expected to shape the future of BI software include:

- Artificial Intelligence and Machine Learning: The integration of AI and ML into BI software to enable more advanced analytics and decision-making.

- Cloud Computing: The increasing adoption of cloud-based BI software to improve scalability and flexibility.

- Mobile Analytics: The growing demand for mobile analytics and reporting to enable on-the-go decision-making.

- Big Data Analytics: The increasing importance of big data analytics to enable organizations to analyze large amounts of data from various sources.

As the business landscape continues to evolve, the importance of BI software in financial analysis will only continue to grow. By staying ahead of the curve and embracing the latest trends and technologies, organizations can ensure that they are well-equipped to make informed decisions and drive business success.

Closure

Thus, we hope this article has provided valuable insights into Business Intelligence Software for Smarter Financial Analysis. We hope you find this article informative and beneficial. See you in our next article!