Business Intelligence Software for Better Financial Planning

In today’s fast-paced business landscape, accurate financial planning is crucial for organizations to stay ahead of the competition. With the vast amount of data available, it can be overwhelming to make sense of it all and make informed decisions. This is where Business Intelligence (BI) software comes in – a powerful tool that helps organizations to analyze and interpret complex data, making it easier to create effective financial plans.

What is Business Intelligence Software?

Business Intelligence software is a set of tools and applications that enable organizations to collect, analyze, and visualize data from various sources. This software helps to identify trends, patterns, and correlations within the data, providing valuable insights that can inform business decisions. BI software can be used to analyze various types of data, including financial, operational, customer, and market data.

Benefits of Business Intelligence Software for Financial Planning

The use of Business Intelligence software for financial planning offers numerous benefits, including:

- Improved Accuracy: BI software helps to eliminate manual errors and inconsistencies in data analysis, providing a more accurate picture of an organization’s financial performance.

- Enhanced Visibility: With BI software, organizations can gain real-time visibility into their financial data, enabling them to respond quickly to changes in the market or business environment.

- Data-Driven Decision Making: BI software provides organizations with the insights they need to make informed, data-driven decisions about financial planning and strategy.

- Increased Efficiency: BI software automates many of the tasks associated with financial planning, such as data collection and analysis, freeing up staff to focus on higher-value activities.

- Better Forecasting: BI software enables organizations to create more accurate forecasts, which can help to identify potential financial risks and opportunities.

Key Features of Business Intelligence Software for Financial Planning

When selecting a Business Intelligence software for financial planning, there are several key features to consider, including:

- Data Integration: The ability to integrate data from multiple sources, such as accounting systems, customer relationship management (CRM) systems, and external data sources.

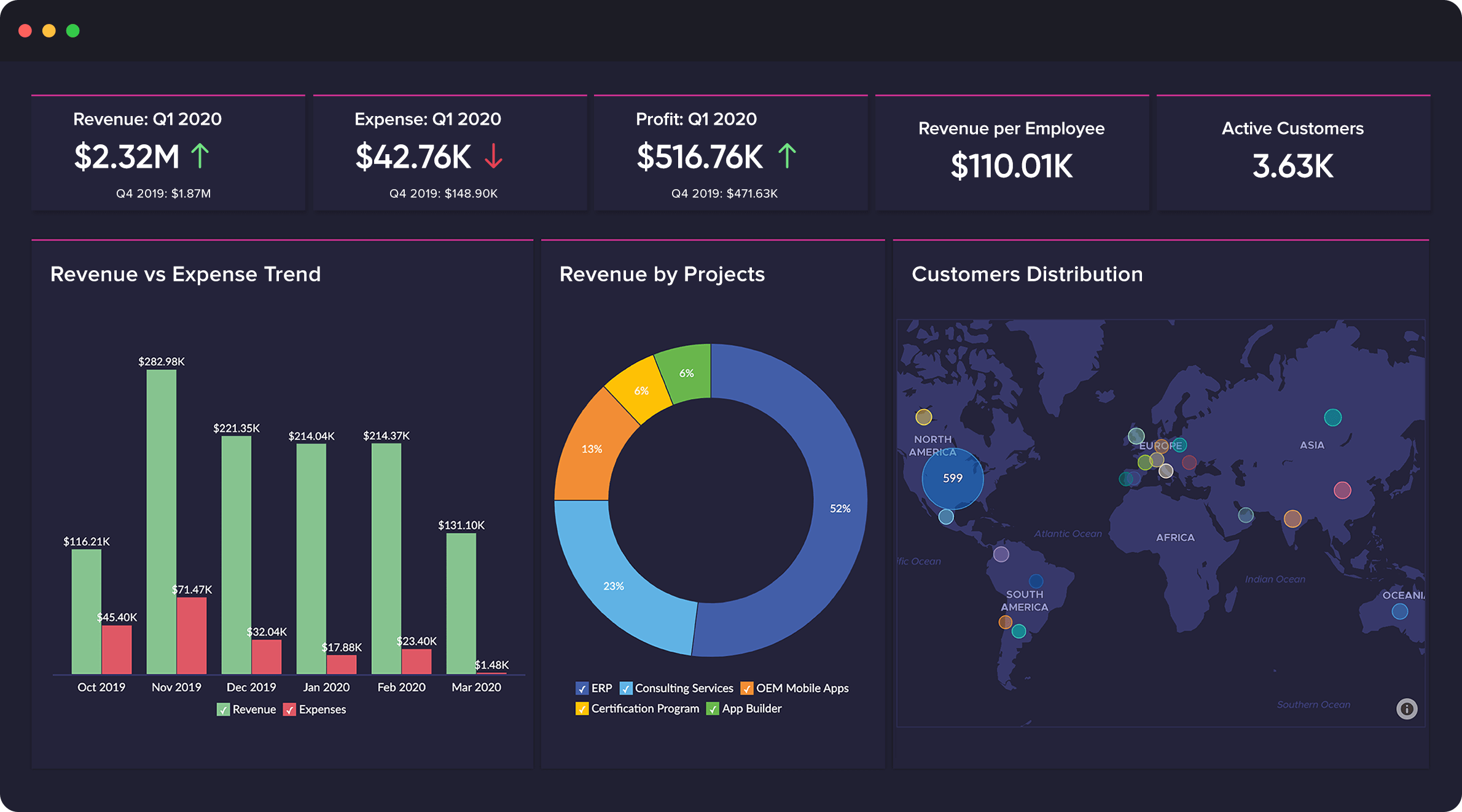

- Data Visualization: The ability to present complex data in a clear and concise manner, using visualizations such as charts, graphs, and dashboards.

- Predictive Analytics: The ability to use statistical models and algorithms to forecast future financial performance.

- Budgeting and Forecasting: The ability to create and manage budgets and forecasts, and to track actual performance against planned targets.

- Collaboration: The ability to share data and insights with stakeholders, and to collaborate on financial planning and decision making.

Top Business Intelligence Software for Financial Planning

There are many Business Intelligence software options available for financial planning, including:

- Tableau: A popular data visualization tool that enables organizations to connect to a wide range of data sources and create interactive dashboards.

- Microsoft Power BI: A business analytics service that enables organizations to create interactive visualizations and business intelligence reports.

- SAP BusinessObjects: A comprehensive BI platform that enables organizations to analyze and visualize data from multiple sources.

- Oracle Business Intelligence: A suite of BI tools that enables organizations to analyze and visualize data from multiple sources.

- IBM Cognos: A comprehensive BI platform that enables organizations to analyze and visualize data from multiple sources.

Best Practices for Implementing Business Intelligence Software for Financial Planning

To get the most out of Business Intelligence software for financial planning, there are several best practices to follow, including:

- Define Clear Goals and Objectives: Identify the key financial planning objectives that the BI software will help to achieve.

- Choose the Right Software: Select a BI software that meets the organization’s specific needs and requirements.

- Develop a Data Governance Plan: Establish a plan for managing and maintaining the quality and integrity of the data used in the BI software.

- Provide Training and Support: Provide training and support to users to ensure that they can effectively use the BI software.

- Continuously Monitor and Evaluate: Continuously monitor and evaluate the effectiveness of the BI software, and make adjustments as needed.

Common Challenges and Pitfalls

While Business Intelligence software can be a powerful tool for financial planning, there are several common challenges and pitfalls to be aware of, including:

- Data Quality Issues: Poor data quality can limit the effectiveness of the BI software, and can lead to inaccurate insights and decisions.

- User Adoption: If users are not properly trained or supported, they may not use the BI software effectively, which can limit its value.

- Integration Challenges: Integrating the BI software with other systems and data sources can be complex and time-consuming.

- Cost and Resource Constraints: Implementing and maintaining a BI software can require significant investment of time and resources.

- Security and Governance: Ensuring the security and governance of the data used in the BI software is critical to preventing data breaches and other security threats.

Conclusion

Business Intelligence software is a powerful tool for financial planning, offering numerous benefits, including improved accuracy, enhanced visibility, and data-driven decision making. By selecting the right software, following best practices, and being aware of common challenges and pitfalls, organizations can get the most out of their BI software and create effective financial plans that drive business success. Whether you are a small business or a large enterprise, Business Intelligence software can help you to make informed, data-driven decisions that drive financial planning and strategy.

Closure

Thus, we hope this article has provided valuable insights into Business Intelligence Software for Better Financial Planning. We appreciate your attention to our article. See you in our next article!