How Business Intelligence Software Improves Financial Decision-Making

In today’s fast-paced and competitive business landscape, making informed financial decisions is crucial for companies to stay ahead of the curve. With the vast amount of data being generated every day, it can be overwhelming for financial professionals to sift through and make sense of it all. This is where Business Intelligence (BI) software comes into play. BI software has revolutionized the way companies approach financial decision-making, enabling them to make data-driven decisions that drive business growth and profitability.

What is Business Intelligence Software?

Business Intelligence software is a set of tools and technologies that help organizations to transform raw data into meaningful and actionable insights. It enables companies to collect, analyze, and visualize data from various sources, such as financial reports, customer interactions, and market trends. BI software provides a 360-degree view of the business, allowing financial professionals to identify areas of improvement, optimize processes, and make informed decisions.

Benefits of Business Intelligence Software for Financial Decision-Making

The benefits of using BI software for financial decision-making are numerous. Some of the key advantages include:

- Improved Financial Analysis: BI software provides financial professionals with the ability to analyze large datasets, identify trends, and detect patterns. This enables them to make more accurate financial forecasts and predictions, reducing the risk of errors and misinterpretations.

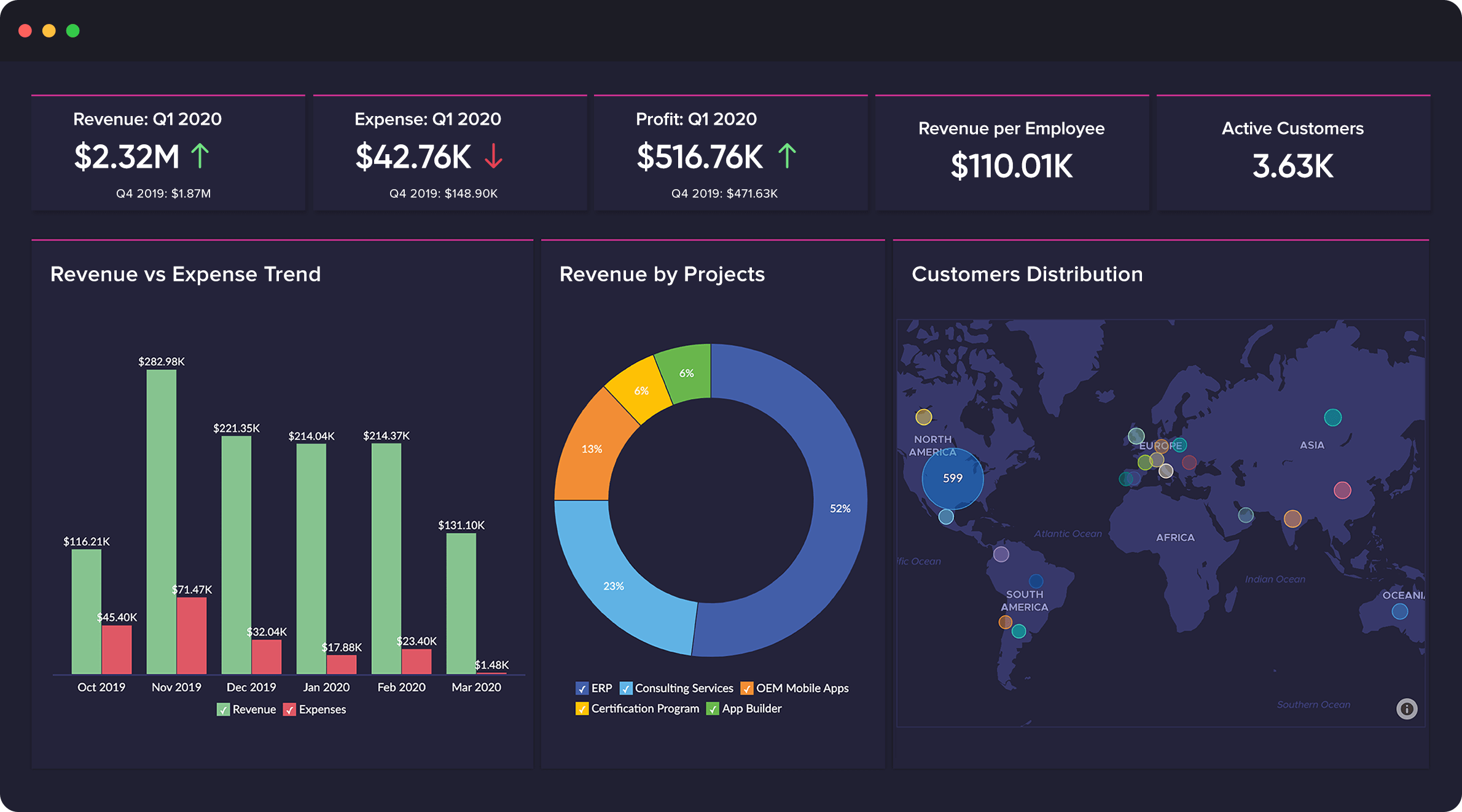

- Enhanced Data Visualization: BI software offers a range of data visualization tools, such as charts, graphs, and dashboards, that help financial professionals to present complex financial data in a clear and concise manner. This facilitates better communication and collaboration among stakeholders.

- Real-Time Data Access: BI software provides real-time access to financial data, enabling financial professionals to respond quickly to changes in the market or business. This enables companies to stay agile and adaptable in a rapidly changing business environment.

- Automated Reporting: BI software automates the reporting process, freeing up financial professionals to focus on higher-value tasks such as financial analysis and planning. Automated reporting also reduces the risk of errors and ensures that reports are delivered on time.

- Better Decision-Making: By providing financial professionals with timely and accurate insights, BI software enables them to make better-informed decisions that drive business growth and profitability.

Key Features of Business Intelligence Software for Financial Decision-Making

When selecting a BI software for financial decision-making, there are several key features to look out for. Some of the most important features include:

- Data Integration: The ability to integrate data from multiple sources, such as financial reports, customer interactions, and market trends.

- Data Analytics: Advanced analytics capabilities, such as predictive analytics, regression analysis, and statistical modeling.

- Data Visualization: A range of data visualization tools, such as charts, graphs, and dashboards, to present complex financial data in a clear and concise manner.

- Real-Time Data Access: Real-time access to financial data, enabling financial professionals to respond quickly to changes in the market or business.

- Collaboration Tools: Collaboration tools, such as dashboards and scorecards, to facilitate communication and collaboration among stakeholders.

- Security and Compliance: Robust security and compliance features, such as data encryption and access controls, to ensure that financial data is protected and secure.

Best Practices for Implementing Business Intelligence Software for Financial Decision-Making

Implementing BI software for financial decision-making requires careful planning and execution. Some best practices to keep in mind include:

- Define Clear Goals and Objectives: Clearly define the goals and objectives of the BI software implementation, such as improving financial analysis or enhancing data visualization.

- Assess Data Quality: Assess the quality of the data to be used in the BI software, ensuring that it is accurate, complete, and up-to-date.

- Choose the Right Software: Choose a BI software that meets the needs of the organization, with the right features and functionalities.

- Train and Support Users: Provide training and support to users, ensuring that they are able to use the BI software effectively and efficiently.

- Monitor and Evaluate: Monitor and evaluate the effectiveness of the BI software, making adjustments and improvements as needed.

Case Studies: Business Intelligence Software in Action

Several companies have successfully implemented BI software to improve financial decision-making. Here are a few examples:

- Coca-Cola: Coca-Cola implemented a BI software to analyze sales data and identify trends. The company was able to increase sales by 10% and reduce costs by 15%.

- Wal-Mart: Wal-Mart implemented a BI software to analyze customer data and optimize pricing and inventory management. The company was able to increase sales by 5% and reduce inventory costs by 10%.

- Bank of America: Bank of America implemented a BI software to analyze financial data and identify areas of improvement. The company was able to reduce costs by 12% and improve customer satisfaction by 15%.

Conclusion

Business Intelligence software has revolutionized the way companies approach financial decision-making. By providing financial professionals with timely and accurate insights, BI software enables them to make better-informed decisions that drive business growth and profitability. With its ability to integrate data from multiple sources, analyze complex financial data, and present insights in a clear and concise manner, BI software is an essential tool for any organization looking to improve financial decision-making. By following best practices and choosing the right software, companies can unlock the full potential of BI software and achieve significant improvements in financial performance.

Closure

Thus, we hope this article has provided valuable insights into How Business Intelligence Software Improves Financial Decision-Making. We thank you for taking the time to read this article. See you in our next article!